Nine steps to zero: How iPaladin and Canoe eliminated Third Lake’s manual workflows

Introduction: The Third-Generation Challenge

In 2019, Robert Forsythe, CEO of Third Lake Capital, faced a critical mission: protect his Forbes 400 family’s wealth from the third-generation curse of dissipation. Managing over 500 LLCs and trusts, Third Lake relied on outdated tools—Excel, QuickBooks, and SharePoint—that risked errors, delays, and loss of family trust. With over 1,000 statements arriving in inconsistent formats each year, Robert saw clearly: without structure, the family’s legacy was vulnerable.

This case study, crafted for family office leaders seeking to modernize operations, explores how Robert’s vision transformed Third Lake into a model of efficiency and trust through two complementary innovations. Together, these solutions create a scalable, repeatable process—anchored in iPaladin’s governance model and powered by Canoe’s automation—that preserves institutional continuity while streamlining document workflows.

The Problem: Manual Chaos in Family Offices

Founded in 2013 as an embedded family office, Third Lake Capital became an independent single-family office by 2015, when Robert joined as COO. A CPA with process consulting experience at PwC, he found an office dependent on manual systems. Like many family offices, Third Lake had grown organically, leading to inefficiencies:

- Fragmented Data: Over 1,000 statements, tax forms, and documents arrived yearly from 10+ custodians, 100+ alternative funds, and 15+ CPA and law firms, in varied formats and schedules. Staff logged in manually, downloaded, renamed, and uploaded documents—relying on personal memory instead of structured systems.

- Disconnected Tools: Operations depended on disparate function-specific systems with no integration. Robust general ledger and portfolio tools were being used, but manual operations clogged reporting timelines. “There was nothing built to streamline operations end-to-end,” Robert said, forcing reliance on email and informal processes.

- High Risks: Compliance tracking via inboxes and spreadsheets was fragile, and staff turnover threatened knowledge loss. “The risk of something not happening when it needs to is so high,” Robert warned.

These issues were not unique to Third Lake. Industry-wide, family offices have failed to keep up with technology. Third Lake needed to institutionalize its operations to preserve trust and legacy.

iPaladin Institutionalized the Office — Canoe Powered Its Scale

After evaluating numerous vendors, Robert sought a transformative solution. At a 2019 Florida conference, he met Jill Creager, iPaladin’s Founder and CEO, whose vision for unified processes stood out. Later, while researching automation for alternative investments, he discovered Canoe Intelligence—a leader in AI-driven document collection. Together, iPaladin and Canoe institutionalized Third Lake’s operations.

iPaladin: The Foundation

Jill, a veteran T&E attorney, challenged Robert to leave behind siloed systems like email, spreadsheets, and CRMs—tools never designed to handle the interplay of fiduciary data, documents, and relationships at scale. iPaladin offered a unified platform that mirrored family structures, managing documents, workflows, and relationships with role-based access.

“Like a general ledger for numbers, a family office system must unify documents and processes,” Jill explained.

Within six months, Robert implemented iPaladin and transformed operations:

- Unified Documents: Automated naming and tagging eliminated 40% document duplication, linking records to multiple entities or processes.

- Automated Workflows: Templates institutionalized expertise, turning one-off decisions into enduring processes and automating compliance with pre-assigned roles, cutting 6 manual steps per document.

- Team Transparency: Role-based workflows and messaging reduced coordination time by 50%, connecting staff, family, and advisors.

- Clear Metrics: Dashboards reduced process complexity by 70%, surfacing optimization insights.

- Audit-Ready Records: Audit trails enabled auditors to self-service documents, reducing audit time from weeks to days.

“iPaladin gives team awareness,” said Tebbi Purvis, President of Third Lake Solutions. “A capital call triggers clear next steps.” Long-range actions—like trust distributions 40–60 years out—were pre-scheduled, ensuring operational continuity across generations.

Canoe: Scaling Efficiency.

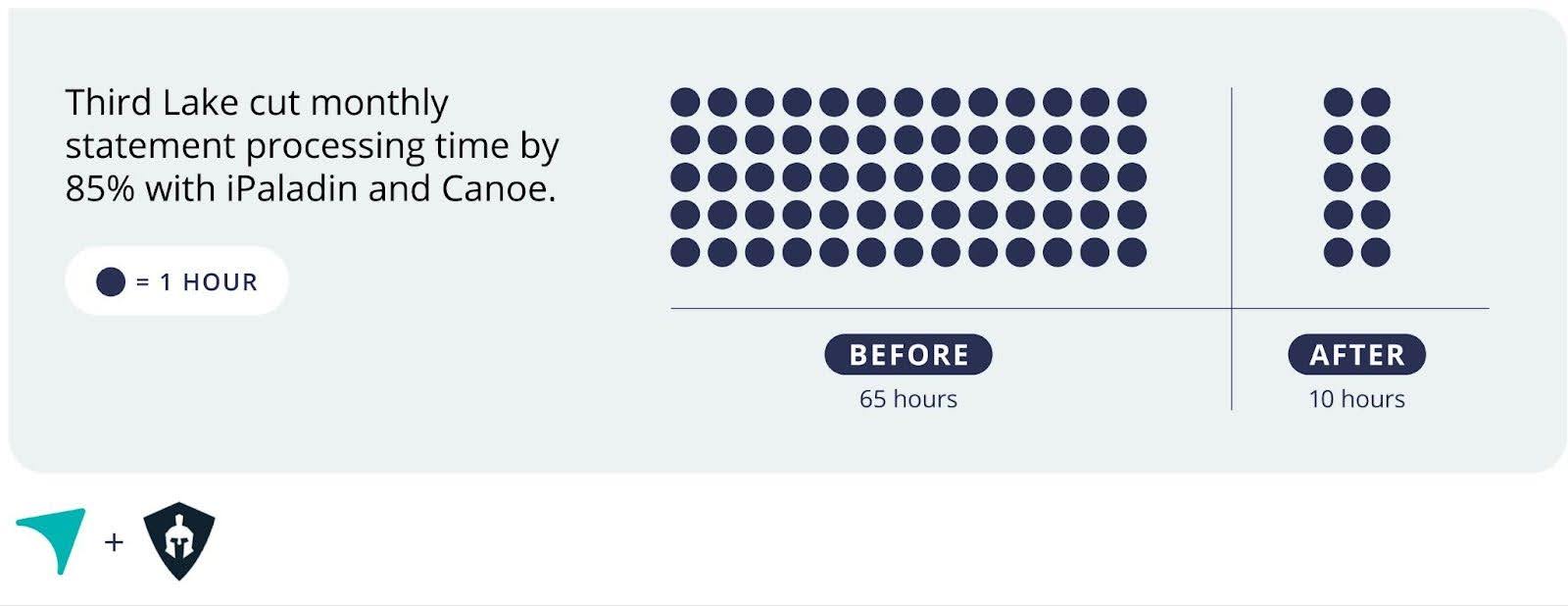

Even with iPaladin streamlining operations, statement ingestion remained a bottleneck—costing 40–66 hours per month. Third Lake processed:

- 683 monthly statements

- 308 quarterly statements

- 104 annual statements

- 529 1099s and K-1s

- 9,772 documents annually

Canoe Intelligence uses purpose-built AI to check fund and custodian portals multiple times daily, automatically retrieving new documents within 24 hours of publication. This tech-first approach eliminates 6 manual steps per document while removing credential handling from staff entirely.

Unlike basic automation tools, Canoe’s AI models—trained on 200M+ alternative investment data points—intelligently consider each document for proper naming, filing, and data capture. This sophisticated extraction synchronizes seamlessly with iPaladin’s workflow engine, transforming raw documents into structured, actionable records.

Integrated with iPaladin, Canoe enabled:

- Automated Collection: Near instant document retrieval across sources with Canoe Connect, even when portals have multi-factor authentication

- Smart Processing: Canoe AI processes documents for naming, filing, and data capture, syncing with general ledgers and performance tools.

- Seamless Workflows: iPaladin’s SmartFlow converts PDFs to structured records, with auto-naming, tagging, filing, and controller alerts.

Ultimately, the Third Lake transformation succeeded because of a unique strategic and technical alignment between iPaladin and Canoe.

“Canoe and iPaladin come from the same ethos when it comes to product design and development. The technical and design aspects of both systems have enabled an integration covering hundreds of data fields, document types, and workflows. This allows Family Offices, such as Third Lake, to effectively institutionalize their operations,” explains Pete Clancey, Canoe’s Director of Family Office Sales.

Many vendors advertise API connectivity but deliver fragmented experiences that still require manual work. In contrast, Canoe and iPaladin operate as a unified ecosystem. Thanks to this, Third Lake benefits from a truly purpose-built solution that was designed end-to-end with their outcomes in mind.

Together, Canoe and iPaladin have eliminated 9 manual steps per document.

Transformational Impact

| Metric | Before | After |

|---|---|---|

| Statement Processing Time | 40–66 hours/month | <10 hours/month (exception handling) |

| Process Complexity | 100% manual, opaque | 90% reduction, transparent |

| Audit Time | Weeks of back-and-forth | Days with self-service |

| Document Duplication | 40% redundant | Eliminated |

The efficiency gains have proven so dramatic that Third Lake evolved beyond its original single-family office mandate. Third Lake Solutions now serves 10+ families via the same operational framework, proving that institutional-grade operations don’t require institutional-sized teams.

“Turnover may be inevitable, but iPaladin and Canoe ensure our processes endure,” Robert reflects.

Why It Matters

iPaladin shifted Third Lake from reactive workarounds to a structured, institutional model. Canoe then amplified this structure with automated, scalable ingestion, unlocking efficiency gains across thousands of documents.

The breakthrough for Third Lake came from using the two in concert. While iPaladin created institutional-grade processes, Canoe ensured those processes could scale without proportional headcount. This dual approach solved both sides of the family office challenge: the need for structure AND the need for efficiency.

The integration saves an estimated $250,000 annually in staff time and cuts audit costs by 50%. Family members gain direct access, with 95% declaring increased trust in the data reported.

| Goal | Stakeholder Benefit | Solution Capability |

|---|---|---|

| Automated Efficiency | Advisor 85% plus reduction in document processing time | AI-powered portal automation with sub-24-hour delivery, automated conversion of documents into structured workflows |

| Scalable Operations | Advisor SFO to MFO transformation without adding headcount | 9,772 documents annually flow through automated collection into institutionalized processes |

| Decision-Making | Family Trusted processes with full visibility | Role-based workflows with approvals and real-time document availability, ensuring current data |

| Transparency | Family Direct record access with 95% satisfaction | Intuitive dashboards reduce complexity by 70%, complete visibility into document collection status |

| Risk Management | Advisor Fewer errors, secure data, never miss deadlines | Automated compliance workflows that eliminate human error |

| Legacy Preservation | Family 40–60-year continuity | Pre-scheduled workflows, contextual records and templates, consistent document naming and preservation |

| Dispute Resolution | Advisor Faster conflict resolution | Comprehensive audit trails from document source to destination |

| Operational Intelligence | Advisor Proactive vs. reactive operations | Shared intelligence network alerts for missing documents, automated exception handling |

Ready to Transform Your Family Office?

Third Lake’s journey proves that lasting operational excellence requires addressing your specific challenges—whether that’s building institutional structure, automating manual workflows, or both.

Build Your Custom Solution

Every family office has unique needs. Explore how these proven technologies can address yours:

- iPaladin: Create institutional-grade structure and unified family office management → ipaladin.com

- Canoe: Eliminate manual document workflows with AI-powered automation → canoeintelligence.com

Learn even more about how iPaladin and Canoe worked together to deliver exponential efficiency gains for Third Lake in the webinar recording.

Institutionalize your family office. Preserve wealth. Build durable trust. Ensure legacy through structure.

About Third Lake Capital / Third Lake Solutions

Founded in 2013, Third Lake Capital began as an embedded family office before evolving into an independent single-family office. Under the leadership of CEO Robert Forsythe, who joined as COO in 2015, the organization expanded to include Third Lake Solutions, a tech-forward multi-family office led by President & CFO Tebbi Purvis. This evolution demanded increasingly sophisticated operational capabilities to serve their growing client base effectively.

About iPaladin

iPaladin, The Digital Family Office®, is a patented command center where complex wealth becomes manageable. This enterprise platform automates daily family office operations through a shared workspace featuring wealth maps, assigned workflows, document libraries and secure permissions. Every family member and advisor can access exactly what they need, when they need it. Positioned alongside general ledger and portfolio reporting systems, iPaladin unifies people, processes, and information across family entities, trusts and investments. The result is built-in transparency and accountability that drive effective collaboration and mitigate risk. This foundation builds trust and ensures the secure data quality that century-long family legacies demand.

About Canoe Intelligence

Canoe Intelligence (“Canoe”) is the platform for smarter alts management. We redefine alternative investment intelligence with AI-driven software that directly addresses the core challenges of private markets. Our technology empowers institutions, LPs, and wealth managers to future-proof their alts infrastructure, modernizing systems and providing a scalable foundation for long-term growth and compliance. By automating manual data processing with AI-native precision, Canoe helps clients reduce operational costs and risks, significantly lowering overhead and mitigating errors. Ultimately, our timely, accurate, and comprehensive data enables investment teams to drive superior investment outcomes through deeper insights and more profitable allocation strategies. With Canoe, it’s all about making Alts, smarter.