Canoe Q3 2025 Cash Flow Report: Capital Movement Across Alternative Investments

CANOE Q3 2025 CASH FLOW REPORT:

Capital Movement Across Alternative Investments

Introducing Canoe’s Quarterly Flow Analysis

Canoe sits at the intersection of fund data flows across the alternative investment industry. Our platform processes primary source documents, capital call notices, distribution notices, and capital account statements, from over 44,000 funds as GPs report to LPs. With over 1 million documents processed monthly and sub-24 hour turnaround, we extract 200 million+ data points that provide real-time visibility into capital movements across $11 trillion in assets under administration.

This network intelligence, drawn from 475+ institutional clients and 18,000+ LPs, provides visibility into capital movements that isn’t available elsewhere. While traditional industry reports rely on surveys, fundraising announcements, or aggregated data released months after quarter-end, Canoe’s analysis draws directly from the documents funds send to their investors—processed in real-time as they’re issued.

This inaugural Flow Report examines capital call and distribution activity across six quarters (Q2 2024 through Q3 2025). We focus on net flows, the difference between contributions called and distributions paid, as the clearest indicator of where capital is actively deploying versus returning.

Going forward, Canoe will deliver these insights quarterly, providing analysis across broad asset classes with strategy-level depth. This is capital flow data as it happens, not as it’s remembered months later.

FINDING #1:

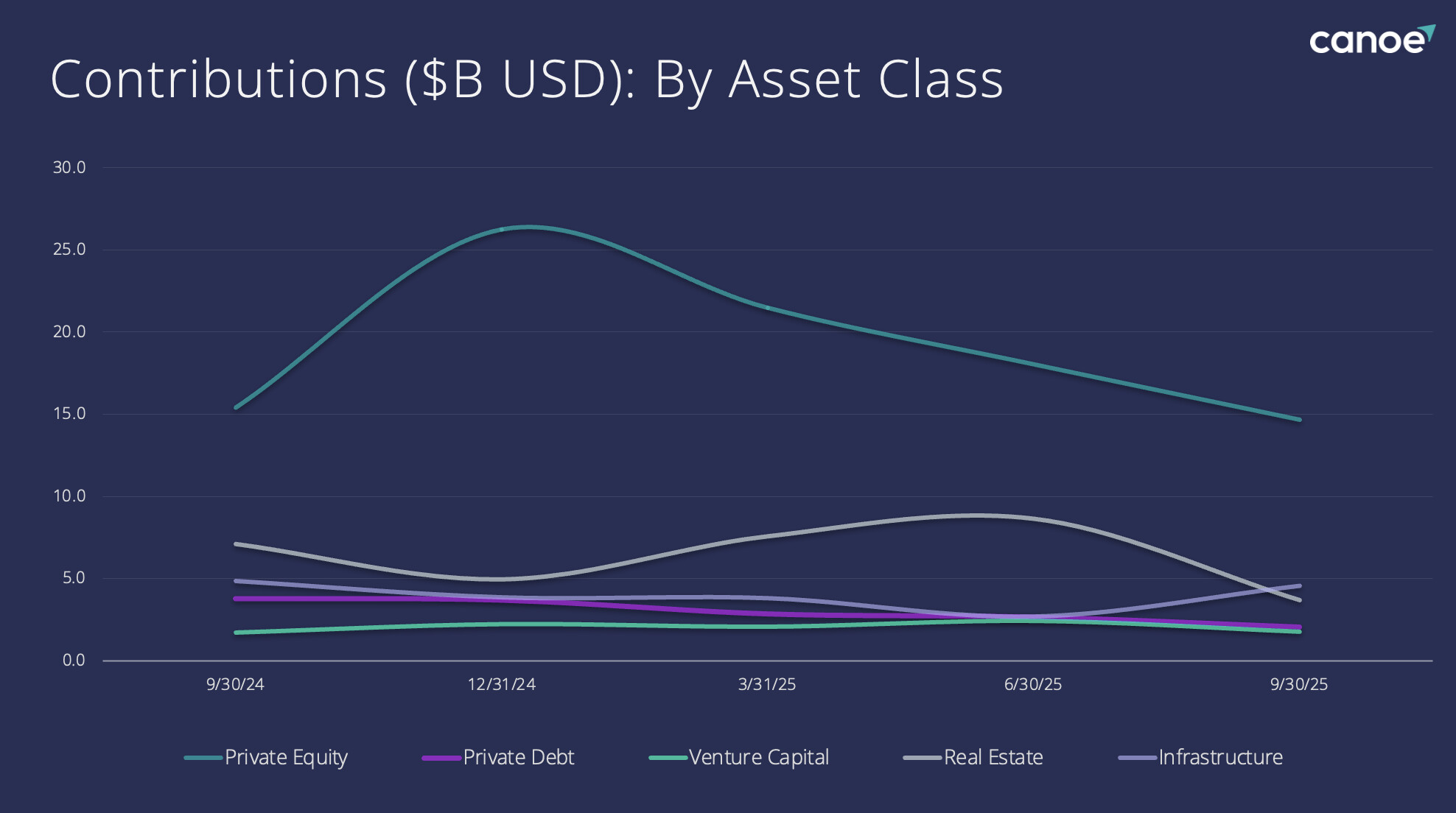

Capital Called Across Most Private Asset Classes Has Declined Over the Past Year

What the data shows:

Contributions to Private Equity have decreased over the last five quarters. Infrastructure had an uptick in called-in capital in Q3 2025.

- Private Equity: Peaked in Q4 2024, then declined steadily through Q3 2025

- Real Estate: Rose to a peak in Q2 2025, then declined sharply in Q3 2025

- Infrastructure: Most stable pattern across the period, with a notable uptick in Q3 2025

- Private Debt: Remained relatively flat throughout the period

- Venture Capital: Remained stable across all quarters

Aggregate contributions show a clear decline from Q4 2024 peak to Q3 2025.

Why this matters:

PE’s decline from peak represents reduction in capital calls quarter over quarter. This slowdown could stem from a lack of compelling deployment opportunities, macroeconomic environment uncertainty, or funds prioritizing exits over new investments to generate liquidity.

However, on a year-over-year basis, PE contributions remain relatively flat, the decline is primarily a quarter-over-quarter phenomenon from the Q4 2024 peak.

Infrastructure’s Q3 uptick stands out as the only asset class accelerating while others slow deployment, likely as a result of market tailwinds in the segment.

Private Debt shows a different pattern: contributions are down both year-over-year and quarter-over-quarter, indicating a more sustained pullback in deployment.

Venture Capital’s stability at lower absolute levels indicates it operates on different deployment cycles than PE, maintaining more consistent call patterns.

FINDING #2:

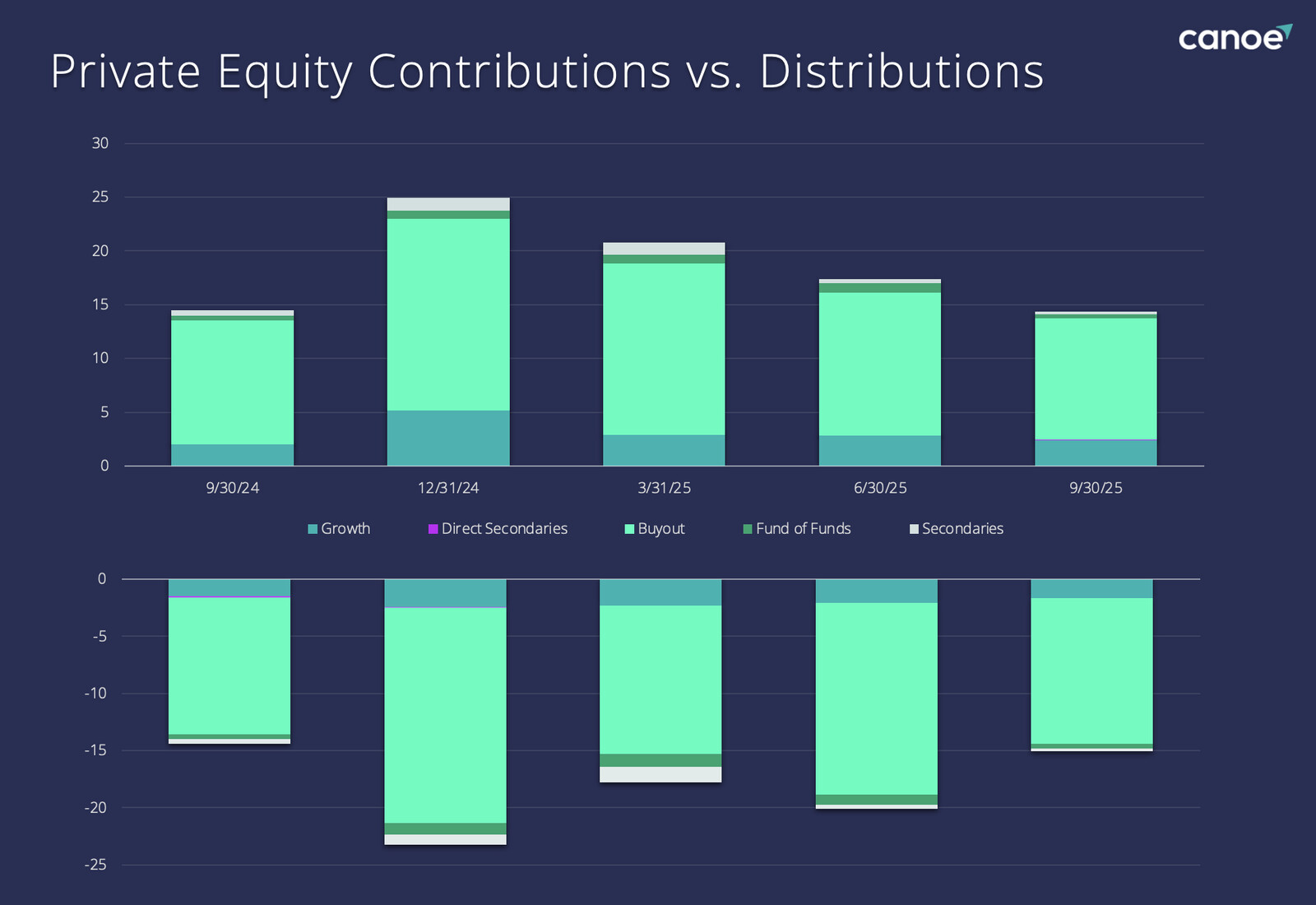

Buyout Distributions Increase in Q2 2025 but Moderately Decline in Q3

What the data shows:

While contributions declined across most PE asset classes, funds increased paid-out capital from buyouts in Q2 2025, with a moderate decline in distributions in Q3.

Contributions (top panel):

- Declined steadily from Q4 2024 through Q3 2025

Distributions (bottom panel):

- Q4 2024: Peak distribution quarter

- Q2 2025: Elevated distributions

- Q3 2025: Returned to lower levels similar to Q3 2024

Buyouts:

Dominate both contributions and distributions across all quarters, representing the vast majority of PE activity. Growth equity is the second-largest component but significantly smaller.

Q3 2025 shows contributions and distributions approaching equilibrium.

Why this matters:

The Q4 2024 and Q2 2025 distribution spikes likely reflect favorable exit windows when PE firms found attractive conditions to exit portfolio companies. The return to lower distribution levels in Q3 2025 combined with declining contributions brings PE to near equilibrium, a shift from years of net capital accumulation.

While Buyouts dominate PE’s total contributions and distribution, the story of net flows is more nuanced. On a net basis, Infrastructure and Private Debt drive the most significant flow patterns despite PE’s larger absolute scale. PE may drive the sample set, but Infrastructure and Private Debt have outsized flows relative to their portfolio weight, making them the asset classes to watch for directional shifts in institutional capital deployment.

FINDING #3:

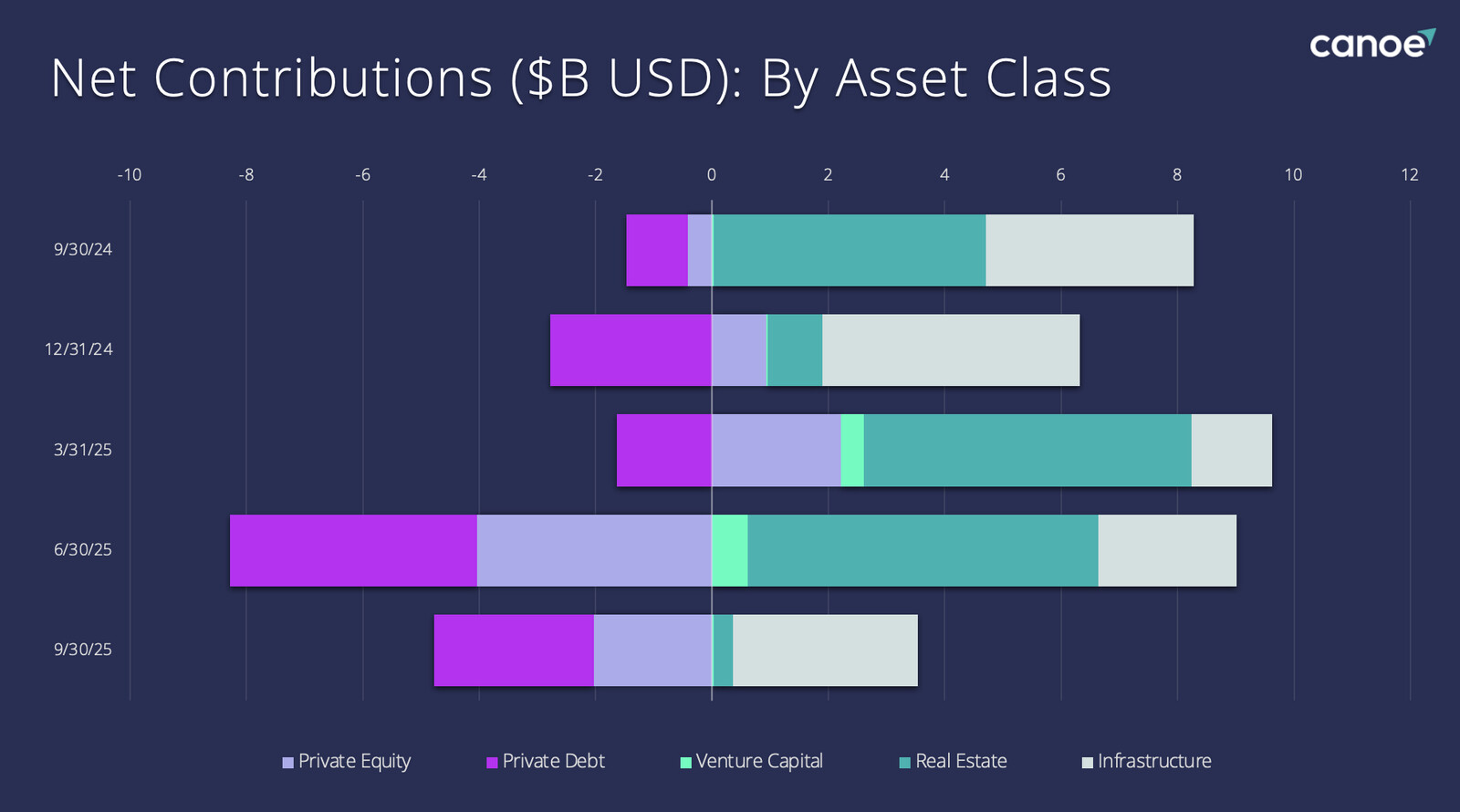

Net Contributions to Infrastructure Outpace Distributions; Private Credit Sees Net Distributions

What the data shows:

Net contributions (calls less distributions) have been positive for Infrastructure and negative for Private Credit since Q3 2024.

- Infrastructure: Positive net flows in four of five quarters, with particularly strong periods in Q3 2024, Q1 2025, and Q2 2025. Q3 2025 showed continued positive flows at a lower level.

- Private Debt: Consistent net outflows across all five quarters, with the largest outflow occurring in Q2 2025.

- Private Equity: Net flows declining toward zero, with Q3 2025 approximately neutral.

- Real Estate: Variable, with largest inflows in Q1 2025 and Q2 2025, then declining in Q3 2025.

- Venture Capital: Modest but consistently positive across all quarters.

Why this matters:

Infrastructure’s consistent positive net flows demonstrate sustained institutional commitment despite the asset class representing a relatively small share of total allocations. LPs continue deploying more capital than they receive back. Private Debt’s flip to consistent net outflows marks a clear inflection point, the strategy is now returning more capital than it’s calling. This could reflect funds reaching maturity, loan portfolios refinancing, or strategic LP rebalancing. PE’s movement toward equilibrium represents stabilization after years of rapid NAV growth.

The divergence between Infrastructure (consistently positive) and Private Debt (consistently negative) over the same period is striking.

FINDING #4:

Private Credit—Distributions Outpace Contributions Past 2 Quarters

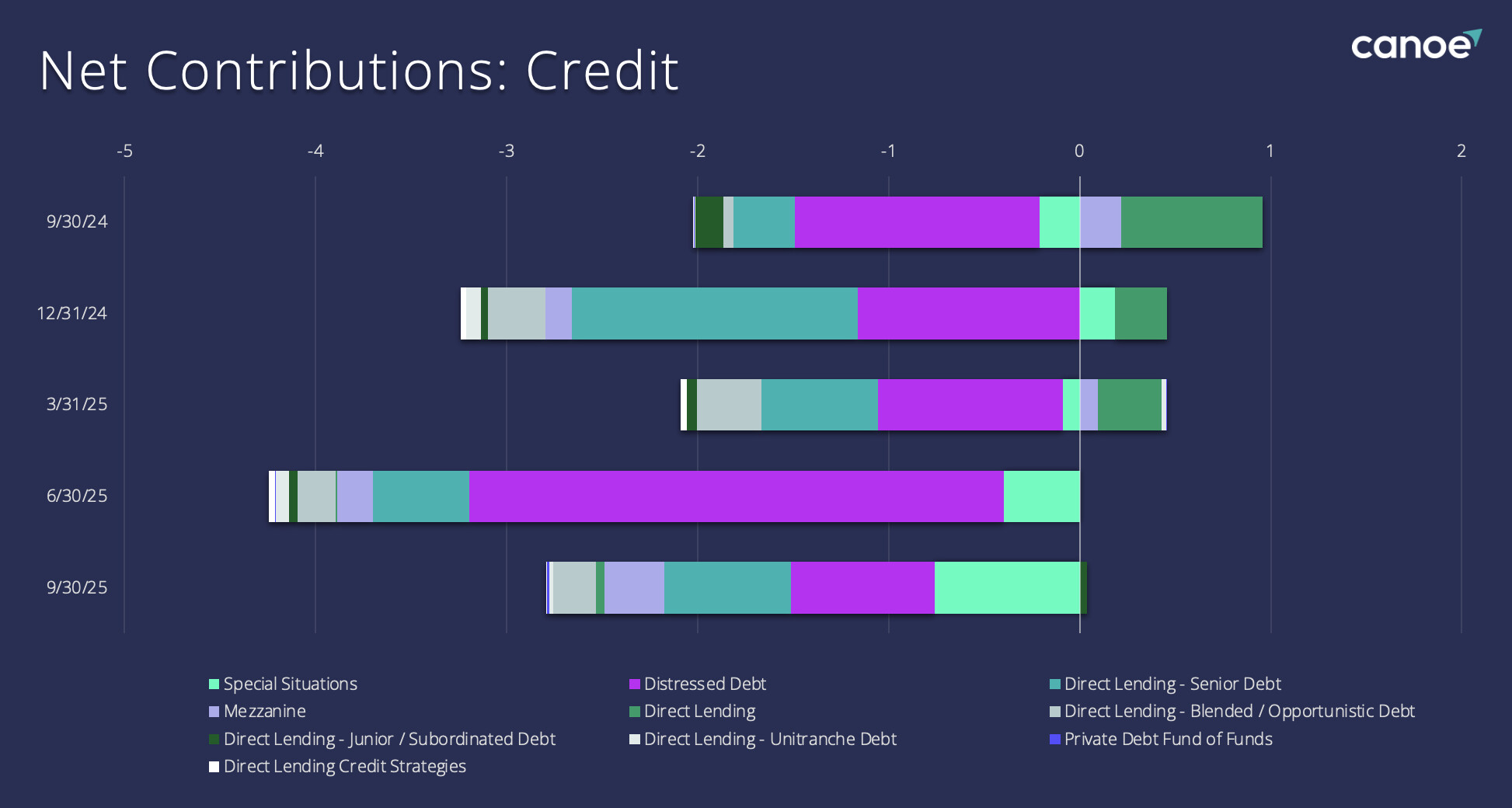

What the data shows:

Private Credit sees net distributions across the board.

Q2 2025 showed the largest aggregate net outflow:

- Distressed Debt: Largest negative contributor

- Direct Lending – Senior Debt: Meaningfully negative

- Direct Lending: Negative

- Mezzanine: Modestly negative

Q3 2025 continued substantial net outflows:

- Distressed Debt: Remained the largest source of net distributions, indicating either a shrinking opportunity set for distressed situations or reduced GP appetite for higher-risk credit strategies in favor of quality

- Direct Lending – Senior Debt: Continued negative flows

- Direct Lending (general): Negative

- Mezzanine: Negative

Earlier quarters (Q3-Q4 2024, Q1 2025): Mixed patterns with Special Situations and Mezzanine showing positive contributions in some quarters, while Distressed Debt showed net outflows at lower magnitudes.

The shift to broad-based net outflows across most Private Debt strategies became pronounced in Q2 2025.

Why this matters:

The breadth of outflows in Q2-Q3 2025 distinguishes this period from earlier quarters. When Distressed Debt, Direct Lending Senior Debt, Mezzanine, and general Direct Lending all simultaneously show net outflows, it indicates category-wide patterns rather than isolated fund or strategy-specific dynamics. The consistent outflows across multiple Private Debt strategies indicate this is a market-wide pattern.

FINDING #5:

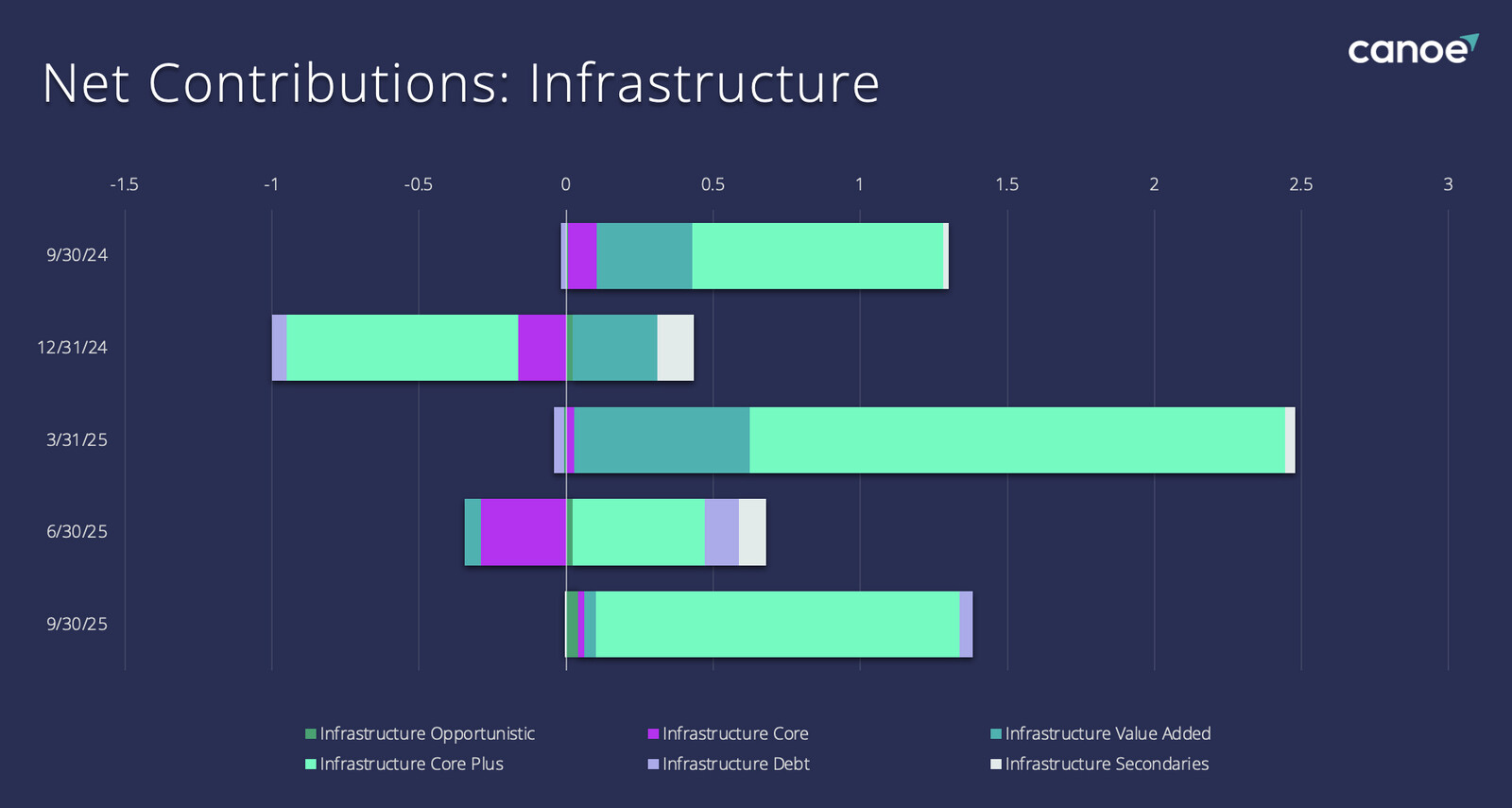

Large Net Contributions to Infrastructure Core Plus in Q3

What the data shows:

Infrastructure has seen meaningful net contributions (capital calls) especially in the Core Plus segment in Q1 and again in Q3 2025.

- Infrastructure Core Plus: Represents the dominant component of positive net flows in Q1 2025 and Q3 2025, driving the majority of Infrastructure’s positive activity in those quarters. This pattern suggests managers are finding more deployment opportunities in lower-risk infrastructure projects.

- Infrastructure Opportunistic: Showed notable positive contributions in Q3 2024 and contributed positively in Q1 2025 and Q3 2025.

- Infrastructure Value Added: Positive contributions visible in Q3 2024 and Q3 2025.

- Infrastructure Core: Generally shows modest net outflows or near neutral positioning across most quarters.

Q4 2024 was the only negative quarter for Infrastructure overall, driven by net outflows across multiple strategies including Core Plus, Core, and Value Added.

Why this matters:

Core Plus strategies, which target stable infrastructure assets with moderate value-creation components, are attracting the bulk of institutional capital. The dominance of Core Plus in Q1 2025 and Q3 2025 indicates managers are finding more compelling deployment opportunities in lower-risk infrastructure projects relative to higher-risk segments like Opportunistic or Value Added.

This deployment pattern reveals institutional risk appetite: when Core Plus drives net flows while Opportunistic shows lower activity, it suggests the market is favoring stable, income-generating assets over higher-risk value creation. Infrastructure Core’s neutral-to-negative positioning suggests these funds are in steady-state operations, while Core Plus continues to accumulate capital as new opportunities emerge.

The concentration in Core Plus versus Opportunistic suggests institutions favor Infrastructure for its income and stability characteristics rather than aggressive value creation.

What These Patterns Reveal

Six quarters of capital flow data reveal clear trends:

Deployment is normalizing. Aggregate contributions have declined significantly from Q4 2024 peaks, with PE leading the slowdown. This suggests a shift from aggressive 2023-2024 deployment toward more measured capital calls.

Asset classes are diverging. Infrastructure maintains strong net inflows while Private Debt records consistent outflows. Real Estate shows volatility. PE approaches equilibrium. Each follows its own deployment and distribution cycle.

Distribution cycles are accelerating. PE, Private Debt, and periodically Real Estate are distributing capital at elevated rates, representing a shift from capital accumulation to capital return.

Strategy-level analysis is essential. Within Infrastructure, Core Plus drives net contributions. Within Private Debt, Distressed leads outflows. Within PE, Buyouts represent the vast majority of flows. Aggregate trends mask critical distinctions.

Save this report as a PDF.

About Canoe Intelligence

Canoe Intelligence (“Canoe”) is the platform for smarter alts management. We redefine alternative investment intelligence with AI-driven software that directly addresses the core challenges of private markets. Our technology empowers institutions, LPs, and wealth managers to future-proof their alts infrastructure, modernizing systems and providing a scalable foundation for long-term growth and compliance. By automating manual data processing with AI-native precision, Canoe helps clients reduce operational costs and risks, significantly lowering overhead and mitigating errors. Ultimately, our timely, accurate, and comprehensive data enables investment teams to drive superior investment outcomes through deeper insights and more profitable allocation strategies. With Canoe, it’s all about making Alts, smarter.

Learn more at www.canoeintelligence.com.