Canoe 2025 Hedge Fund Report: Hedge Fund Returns Across Strategies

CANOE 2025 HEDGE FUND PERFORMANCE REPORT:

Hedge Fund Returns Across Strategies

Introducing Canoe’s Hedge Fund Performance Analysis

Canoe sits at the intersection of fund data flows across the alternative investment industry. Our platform processes over 1 million documents monthly from 44,000+ funds across alternatives, extracting performance data directly from capital account statements, investor letters, and fund reports as GPs report to LPs. This network provides real-time visibility into capital movements across $11 trillion in assets under administration, drawn from 500+ institutional clients and 18,000+ LPs.

For this inaugural Hedge Fund Performance Report, we analyzed 3,126 hedge funds across 2023-2025, drawing from 330,908 documents representing over 10.3 million data points. One critical differentiator: this data is not self-reported. Unlike traditional databases that rely on managers voluntarily submitting returns (typically funds in capital-raising mode), Canoe’s performance indices reflect actual allocations to hedge funds held by institutional investors. This means our data captures some of the largest and most established funds that tend not to report to traditional databases, providing a more accurate estimate of returns actually experienced by allocators.

Monthly VAMI (Value Added Monthly Index) indices represent fund-weighted performance (not dollar-weighted, unless otherwise stated), calculated from actual balances and transactions, net of all fees.

Going forward, Canoe will deliver these insights quarterly, providing analysis across major hedge fund strategies with subsector depth. This is performance data drawn from real portfolios, not survey responses collected months after the fact.

FINDING #1:

Hedge Strategies Preserve and Grow Capital as Markets Rally

What the data shows:

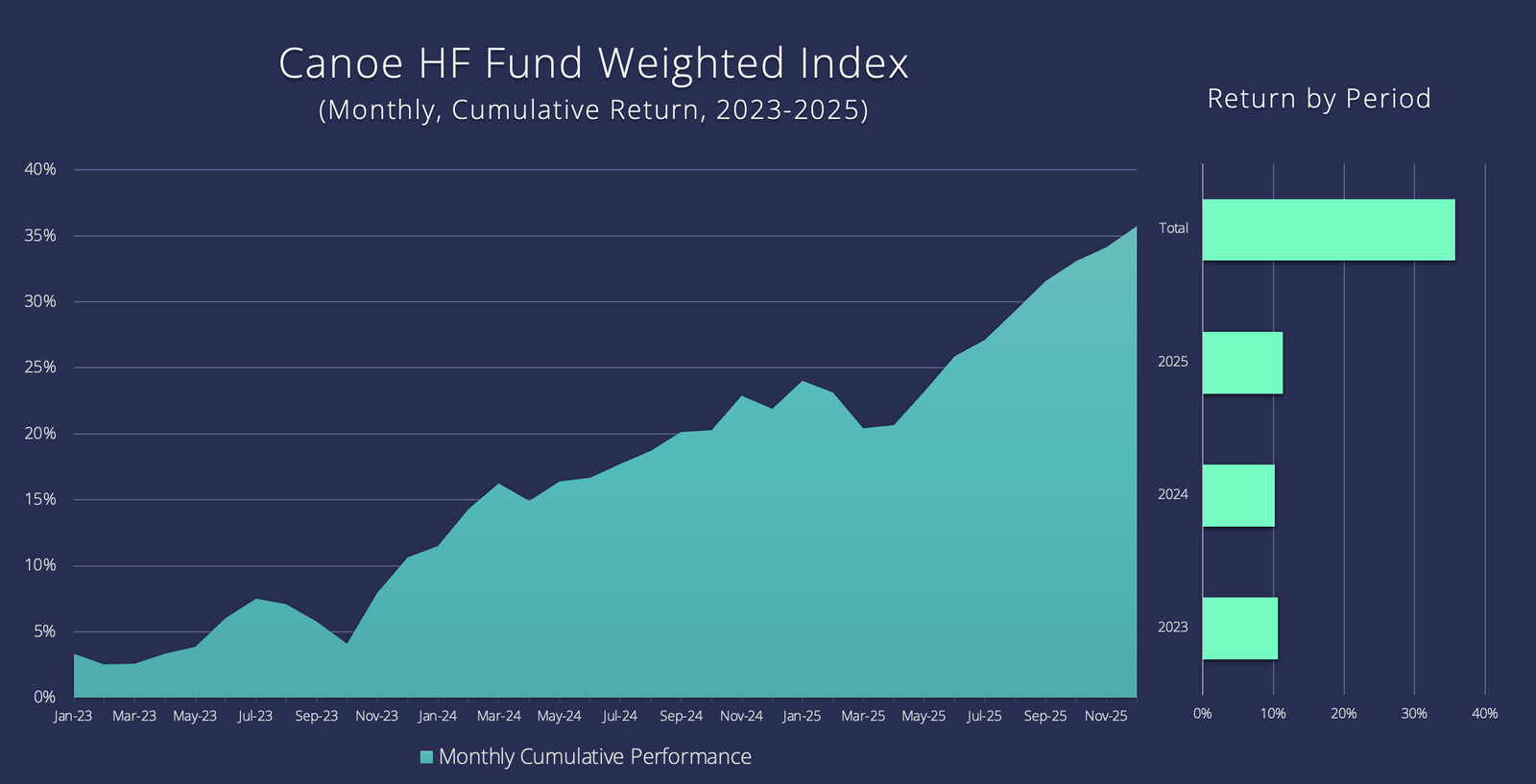

The Total Canoe Hedge Fund Index, excluding fund of funds, returned 10.7% annualized over the past three years, or 36% cumulative.

- 2023: 10.0% annual return

- 2024: 10.9% annual return

- 2025: 11.5% annual return

Performance was consistent across all three years, with steady progression from 2023 through 2025.

Why this matters:

This gain, though sizable, compares to a total return of 85% (with dividends reinvested) for the S&P 500. Hedged strategies rarely take on full exposure to the markets, and if we adjust the S&P by an average of 60% net exposure, benchmark returns drop to 46%, or 13.5% annualized.

These years have been characterized by strong market gains, led by technology stocks. Years of strong performance for the markets usually coincide with relative underperformance for hedged strategies, but investors saw gains mostly in line with exposure-adjusted expected returns.

The performance varied by strategy, and within strategies there was high dispersion between outperforming and underperforming managers, indicating that manager selection mattered. The question for allocators isn’t whether hedge funds matched the S&P 500, but whether they delivered attractive risk-adjusted returns with the downside protection they’re designed to provide.

A note on methodology: The fund universe reflects actual institutional allocations and is subject to both selection and survivorship bias. Selection bias, the tendency for institutional portfolios to favor established, higher-quality managers, is the dominant factor. Survivorship bias, where underperforming funds may have liquidated over the period, is also present to a degree. This means the index likely reflects better-than-average hedge fund performance rather than a pure industry average. However, this characteristic also makes it more representative of the actual returns experienced by institutional allocators, which is the relevant benchmark for most users of this data.

FINDING #2:

Equity Long/Short Strategies Outperform All Other Hedged Strategies

What the data shows:

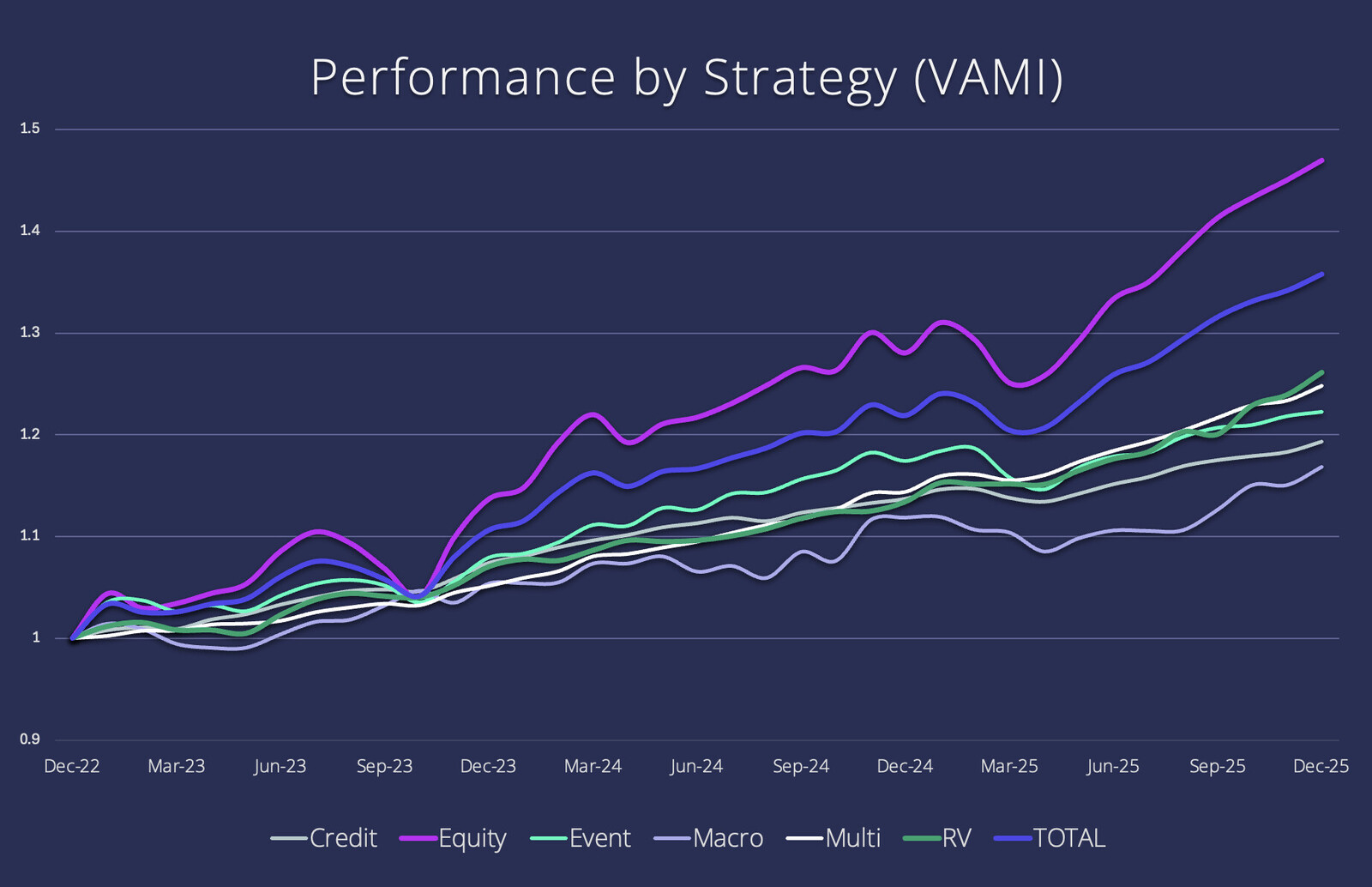

Over the past three years, hedged equity (EQLS) strategies have led overall hedge fund performance, benefiting from the strong market rally and outperforming lower net-exposure and credit strategies. Macro strategies lagged since 2023 but did navigate volatile global markets better than most strategies in fall 2023.

The monthly performance index (VAMI) shows Equity Long/Short consistently outpacing all other strategies throughout the period, with the performance gap between EQLS and other strategies widening particularly through 2024 and 2025. Relative Value, Multi-Strategy, Event Driven, and Credit strategies tracked more closely to each other and to the Total Hedge Fund Index, while Macro consistently trailed.

Why this matters:

The strong performance of EQLS in a market rally reinforces its benefit to allocators seeking hedged returns tied to market gains. Macro’s underperformance is notable given the volatile macroeconomic environment, commodity swings, rate regime shifts, and geopolitical uncertainty typically create opportunities for macro managers. The struggle of Event Driven funds during the spring rally suggests potential sensitivity to specific market regimes less favorable to corporate activity.

Strategy selection proved consequential for portfolio outcomes. An allocator concentrated in Equity Long/Short experienced materially different returns than one focused on Macro or Credit strategies. This performance spread demonstrates that strategy allocation drove results alongside manager selection within strategies.

Equity Long/Short benefited from directional equity beta in a rising market. Lower net-exposure strategies like Relative Value and Event Driven generated more modest returns, consistent with their risk profiles. Understanding which strategies perform in which environments remains essential for portfolio construction.

FINDING #3:

Equity Long/Short Shows Consistent Outperformance; Relative Value Managers Record Strong Year in 2025

What the data shows:

The average hedged equity fund has outperformed all other categories in each of the past three years.

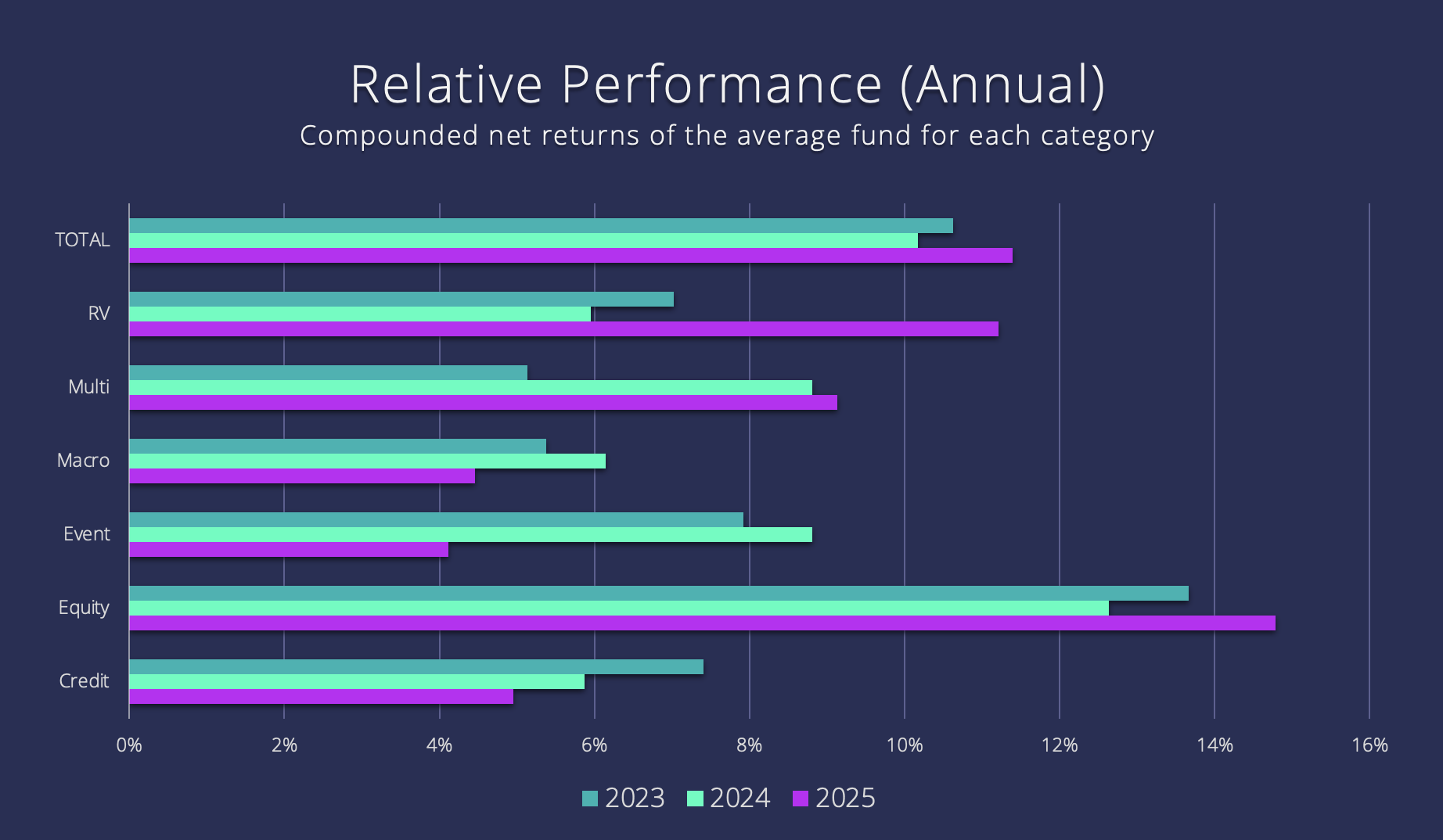

Annual performance by strategy:

2025:

- Equity Long/Short: 15.0% (strongest performer)

- Relative Value: 11.5% (notable acceleration from prior years)

- Multi-Strategy: 9.5%

- Event Driven: 8.8%

- Credit: 7.5%

- Macro: 6.4%

2024:

- Equity Long/Short: 15.5%

- Multi-Strategy: 10.0%

- Relative Value: 7.0%

- Event Driven: 6.5%

- Credit: 6.0%

- Macro: 4.2%

2023:

- Equity Long/Short: 14.0%

- Event Driven: 8.0%

- Macro: 5.8%

- Credit: 5.5%

- Multi-Strategy: 5.0%

- Relative Value: 5.0%

Relative Value funds had a very strong showing in 2025, accelerating from 5.0% in 2023 to 7.0% in 2024 to 11.5% in 2025, outperforming all but equity hedge fund strategies. The average Macro fund underperformed during this period, despite an environment characterized by significant commodity volatility and macroeconomic uncertainty.

Event Driven funds had a challenging time this spring, significantly underperforming the Total Hedge Fund Index in March and April. While all fundamental strategies struggled in March, Event Driven did not rebound as strongly in the summer rally as their EQLS peers.

Why this matters:

Equity Long/Short’s ability to lead performance is expected given its higher equity correlation in a strong equity market. As the strategy most exposed to equity beta, EQLS naturally captured more upside during this three-year rally. The more relevant question for allocators is whether EQLS managers generated alpha beyond their equity exposure, which we’ll examine in Finding #5.

Relative Value’s acceleration is particularly notable, more than doubling returns from 2023 to 2025. This indicates managers found increasingly attractive opportunities, likely from market dislocations or volatility, standing in contrast to the more stable performance trends of other strategies.

FINDING #4:

Manager Dispersion Varies Significantly by Strategy—Selection Matters Most in Equity Long/Short

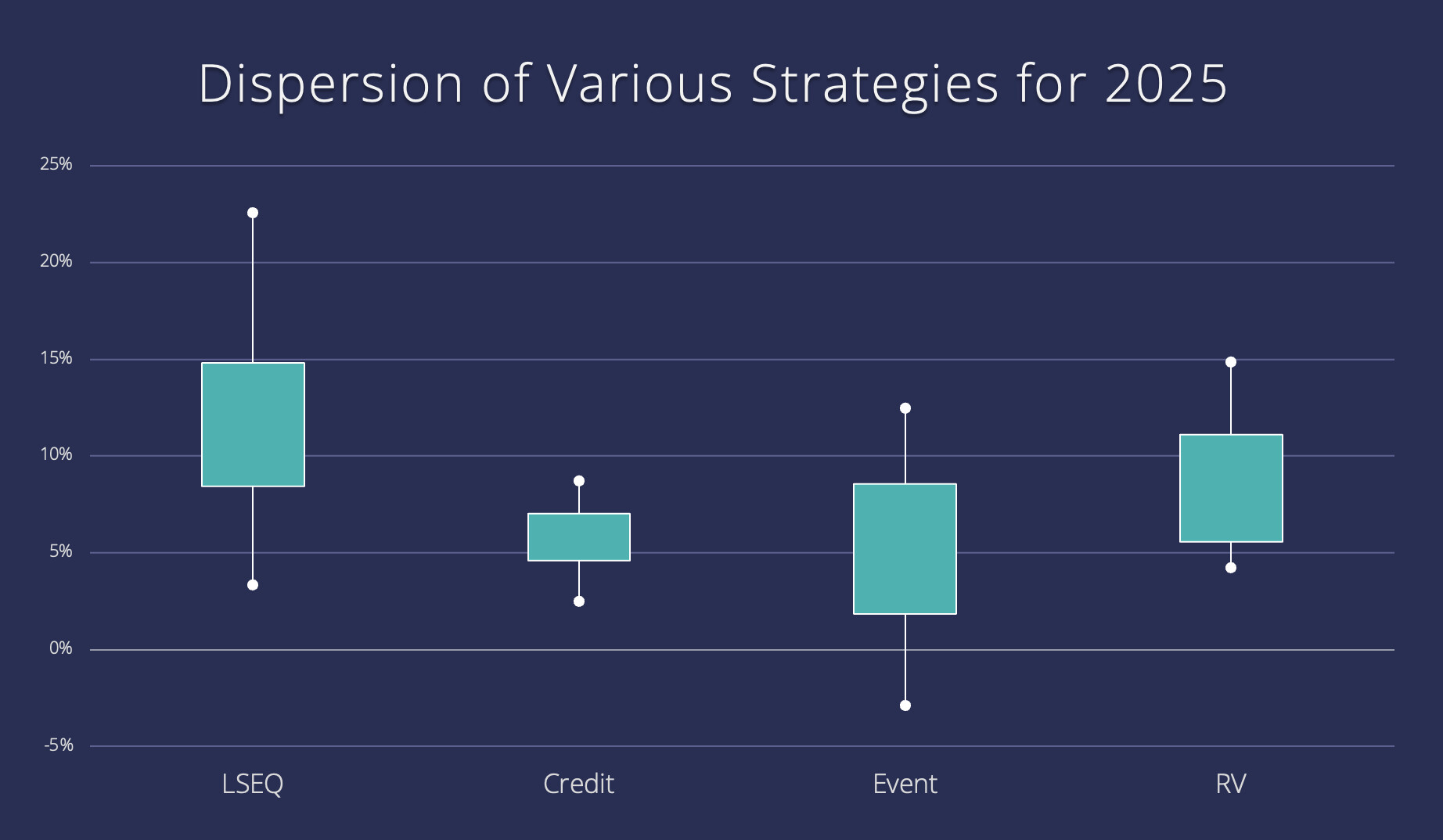

What the data shows:

The dispersion, or the difference between top and bottom quartile managers, varies greatly by strategy. The chart plots the top and bottom quartiles (dots) and the 40th and 60th percentiles (box) for each strategy for 2025.

2025 dispersion by strategy (top to bottom quartile spread):

- Long/Short Equity: 19.0 percentage points (widest dispersion)

- Top quartile: 22.6%

- Bottom quartile: 3.6%

- Event Driven: 15.4 percentage points

- Top quartile: 12.5%

- Bottom quartile: -2.9%

- Relative Value: ~11 percentage points

- Top quartile: 15.1%

- Bottom quartile: 4.2%

- Credit: ~6 percentage points (narrowest dispersion)

- Top quartile: 8.9%

- Bottom quartile: 2.8%

Why this matters:

Manager selection matters more for wide-dispersion strategies like LSEQ than tight dispersion strategies like Credit. Choosing the right strategy matters just as much, if not more, than choosing the right managers within it. Most LSEQ managers outperformed most Event Driven, even though both showed high dispersion between their top and bottom quartile performers.

Some strategies bear skewed downside risk. It hurt allocators more to have chosen bottom quartile managers in Event Driven (down 2.9%) than bottom quartile Relative Value managers (up 4.2%). Bottom quartile performance in Event Driven was negative, while even the weakest Relative Value managers still generated positive returns.

For allocators, this provides a framework for portfolio construction decisions. In wide-dispersion strategies like Equity Long/Short and Event Driven, due diligence and manager selection are critical, the difference between a strong manager pick and a weak one is 19 percentage points in LSEQ. In tight-dispersion strategies like Credit, strategy allocation decisions may matter more than spending extensive resources on manager differentiation, as the performance gap between strong and weak managers is much narrower.

FINDING #5:

Long/Short Equity Managers Outperform Exposure-Adjusted Benchmark

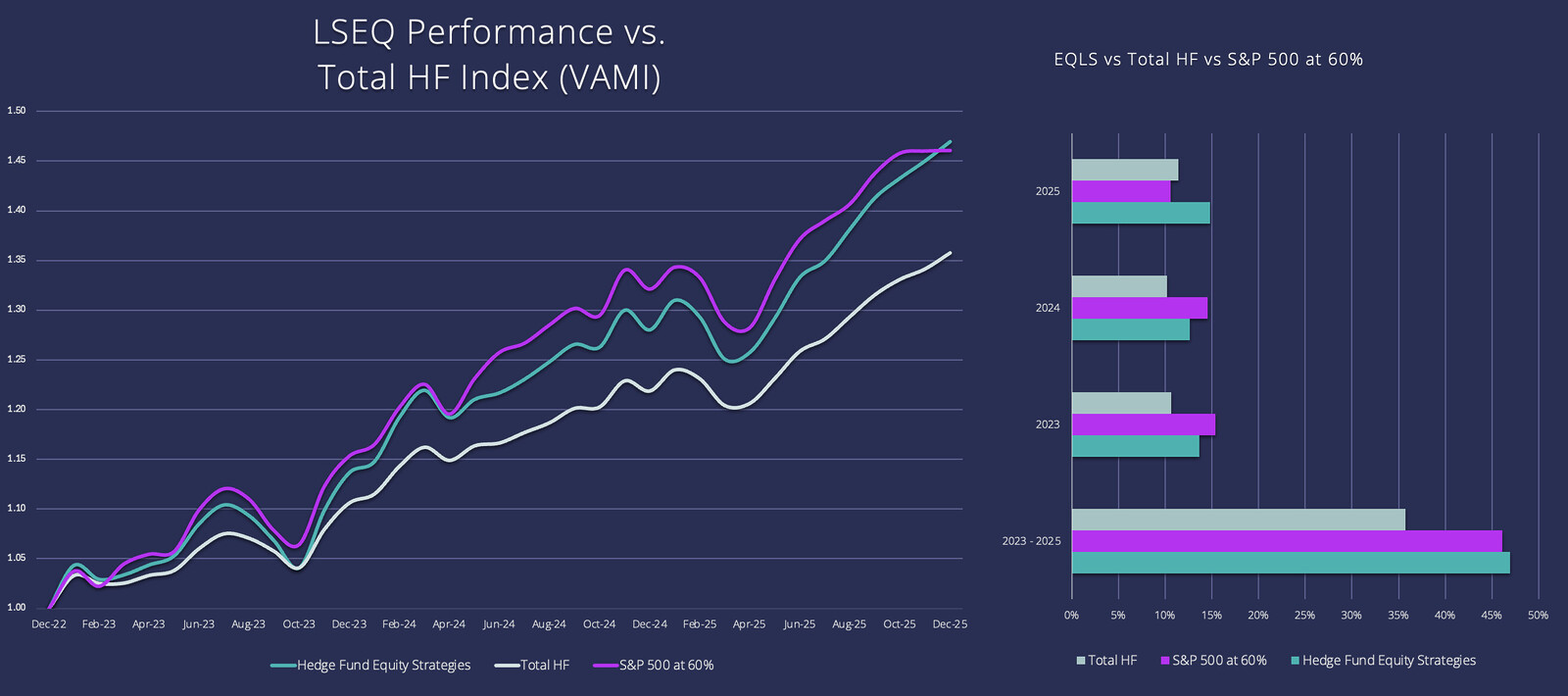

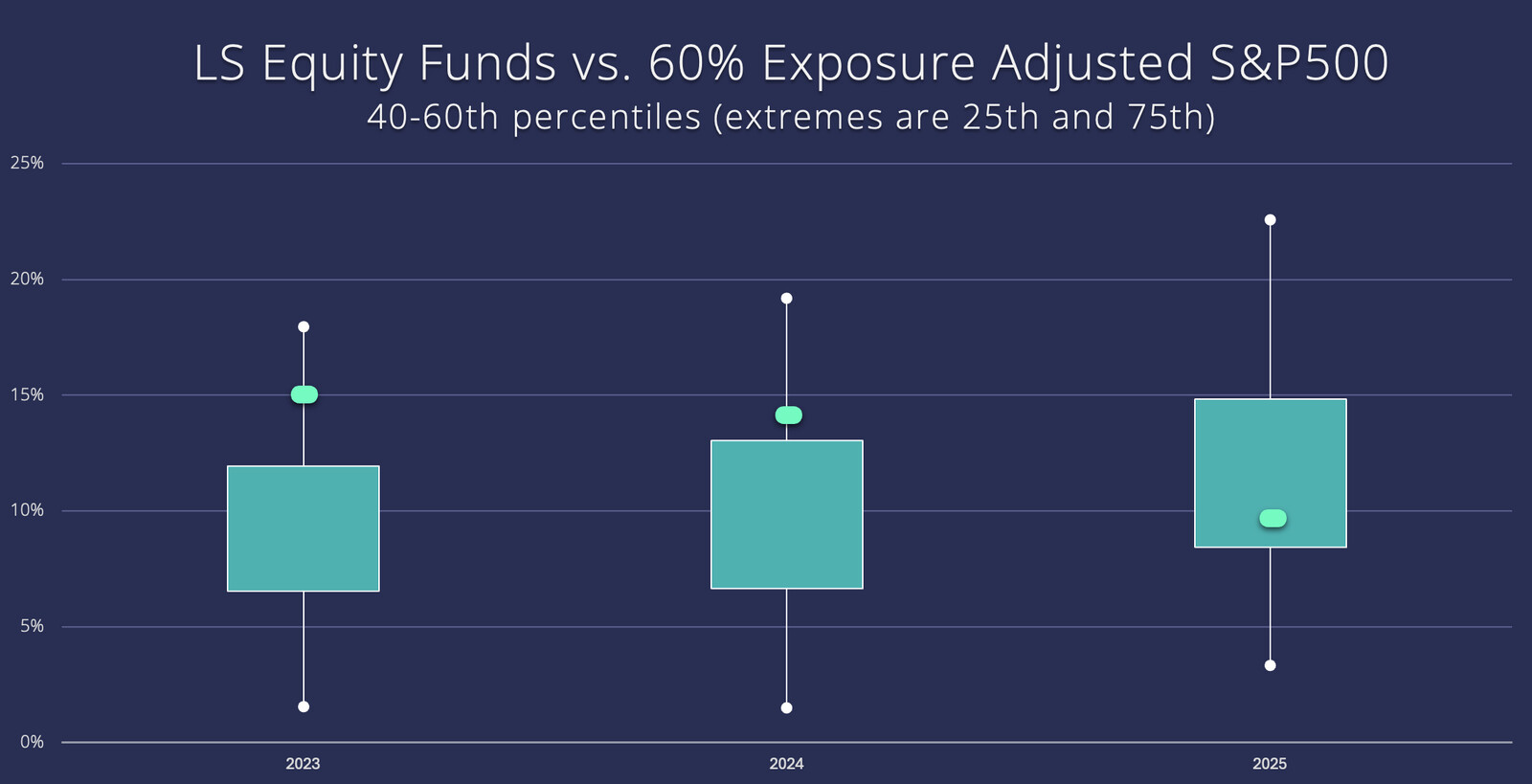

What the data shows:

Even though EQLS was the best performing group of managers, they still lagged the S&P 500, as expected in a market rally. To make the comparison more equitable, we have adjusted the performance of the S&P 500 by a net exposure of 60%, making an assumption that the average EQLS manager carried those exposures throughout the full time period. This is a simplification, as net exposures change over time and the net exposure of managers inside the EQLS strategy varies widely.

Given that assumption, EQLS funds have performed mostly inline with the adjusted benchmark, underperforming slightly in 2023 and 2024, then outperforming in 2025. Overall, EQLS managers squeezed out a narrow win over the benchmark on a three-year cumulative basis.

Relative to the benchmark (Adjusted S&P), EQLS funds have been gaining ground and outperformed in 2025. The top quartile of managers did especially well, generating 22.6% and beating not only the adjusted benchmark but also the actual S&P 500 performance of 18% (with dividends). This implies that allocators who were skilled enough to select top quartile managers generated robust alpha on their allocations in 2025.

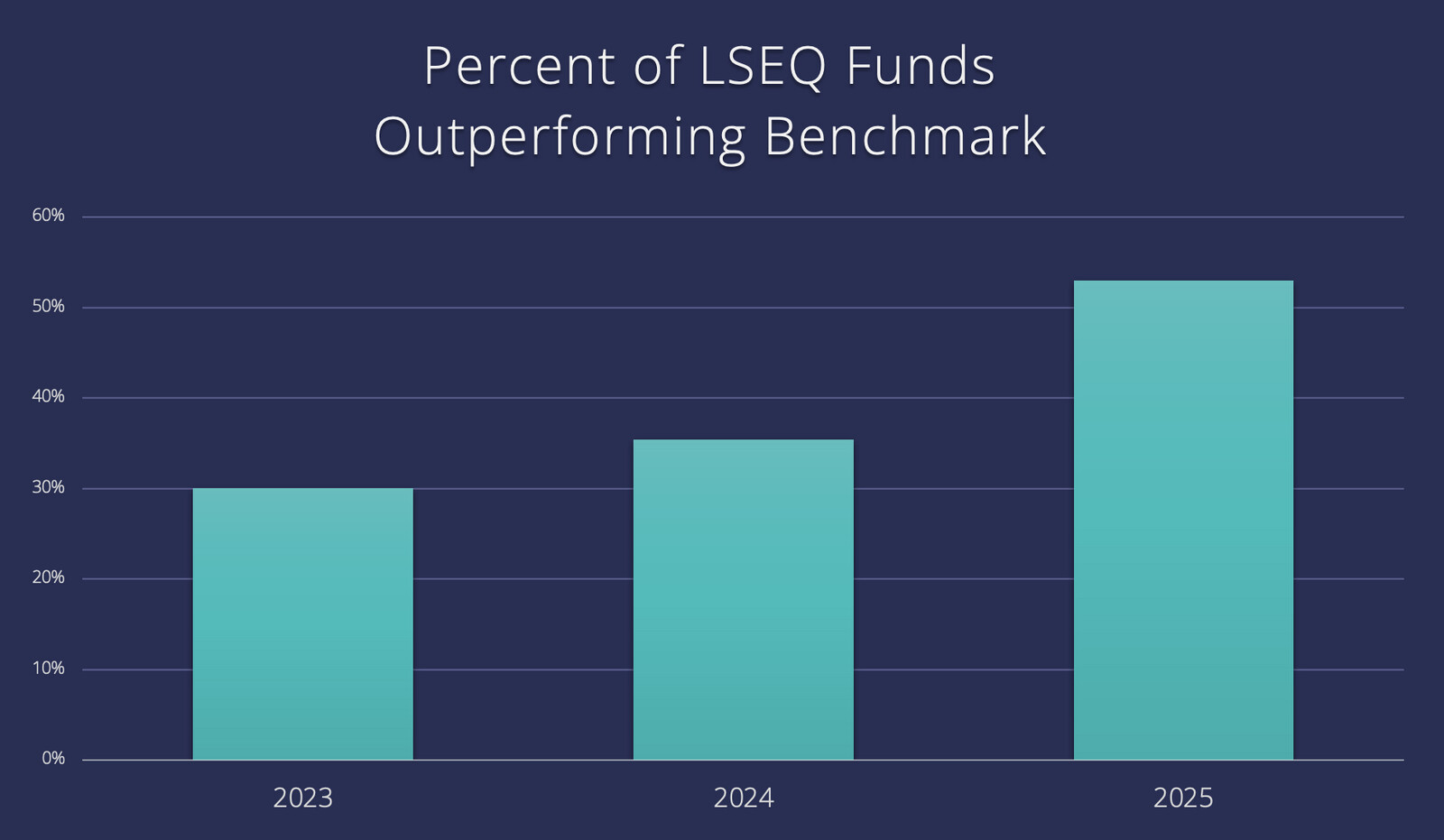

The percent of EQLS funds outperforming the adjusted benchmark has increased in 2024 and 2025:

- 2023: 30% of managers outperformed

- 2024: 36% of managers outperformed

- 2025: 54% of managers outperformed

By 2025, over half the managers in this cohort generated alpha above the adjusted benchmark.

Why this matters:

The 60% exposure adjustment is a simplification, but it provides a more relevant performance hurdle than comparing hedged portfolios to unhedged equity indices. Under this framework, Equity Long/Short managers collectively generated alpha since 2023, (47% vs. 46% for the adj. S&P 500) particularly in 2025. The strategy’s outperformance strengthened over time as managers were more effective at capturing upside while managing downside in recent years.

The percentage of managers beating the adjusted benchmark tells a more nuanced story. In 2023 and 2024, the majority of EQLS managers underperformed even the exposure-adjusted benchmark, with only 30% and 36% outperforming respectively. This shifted in 2025, when 54% of managers beat the benchmark—returning to roughly average performance rather than demonstrating widespread alpha generation.

The story here is the shift from systematic underperformance in the first two years to baseline performance in 2025. This suggests EQLS managers struggled to generate alpha in 2023-2024 even after adjusting for their lower exposure, but that dynamic changed in 2025 as managers became more effective at capturing upside while managing downside.

Top quartile performance is particularly compelling. These managers delivered 22.6% returns, beating the S&P 500 outright while running hedged portfolios. This demonstrates that skilled fundamental investors can outperform despite carrying short positions that drag on returns in rising markets.

What These Patterns Reveal

Taken together, these findings point to three critical dynamics shaping hedge fund performance over the 2023-2025 period.

Strategy selection drove outcomes. The performance gap between strategies was substantial and persistent. Equity Long/Short strategies benefited from sustained equity market gains, while strategies positioned for different market dynamics found fewer opportunities to capitalize during this particular period. An allocator’s strategy mix mattered as much as, if not more than, individual manager selection. In a sustained equity rally, strategies with higher net exposure captured more upside. Lower net-exposure strategies delivered the downside protection they’re designed for, but in an environment that never tested that protection, they underperformed.

Manager selection matters differently by strategy. The 19 percentage point dispersion in Equity Long/Short versus 6 percentage points in Credit shows that in 2025, manager selection was not rewarded equally across strategies. In wide-dispersion strategies, due diligence and manager selection are critical. In tight-dispersion strategies, getting the strategy allocation right may matter more than exhaustive manager differentiation. Some strategies also bear asymmetric downside risk, bottom quartile Event Driven managers posted negative returns while bottom quartile Relative Value managers still generated positive performance.

The importance of Manager Selection in 2025 across categories:

- Equity Long/Short: HIGH

- Event Driven: HIGH

- Relative Value: MEDIUM

- Credit: LOW

Alpha generation is possible in rising markets. The conventional wisdom that hedge funds underperform in bull markets requires nuance. While hedge funds underperformed unhedged equity exposure, many managers generated alpha after adjusting for their risk profiles. By 2025, over half of EQLS managers beat the 60% exposure-adjusted S&P 500, and top quartile managers beat the index outright despite running hedged portfolios. This demonstrates that skilled managers can outperform while maintaining the downside protection hedge fund allocators seek.

The market environment tested hedge fund strategies in a specific way—sustained gains, minimal volatility, concentrated leadership in technology stocks. Different market conditions will test different capabilities. The value of hedged strategies becomes clear when markets turn, but even in this three-year rally, disciplined strategy allocation and manager selection delivered solid risk-adjusted returns.

Save this report as a PDF.

About Canoe Intelligence

Canoe Intelligence (“Canoe”) is the platform for smarter alts management. We redefine alternative investment intelligence with AI-driven software that directly addresses the core challenges of private markets. Our technology empowers institutions, LPs, and wealth managers to future-proof their alts infrastructure, modernizing systems and providing a scalable foundation for long-term growth and compliance. By automating manual data processing with AI-native precision, Canoe helps clients reduce operational costs and risks, significantly lowering overhead and mitigating errors. Ultimately, our timely, accurate, and comprehensive data enables investment teams to drive superior investment outcomes through deeper insights and more profitable allocation strategies. With Canoe, it’s all about making Alts, smarter.

Learn more at www.canoeintelligence.com.