Lower your risk & scale your alts.

Boost your operational efficiency across your fund and manager portfolio.

Why leading FoF's leverage Canoe

Automate collection from funds & managers

Automate document collection and data extraction from all of your invested funds without borrowing your team members during the peak periods.

Access deeper data sets with better data quality

Alts data delivered on time, every time

Backed by the Industry Leaders We Serve

Our investors put their money where data is.

Unlock the full potential of your alts data.

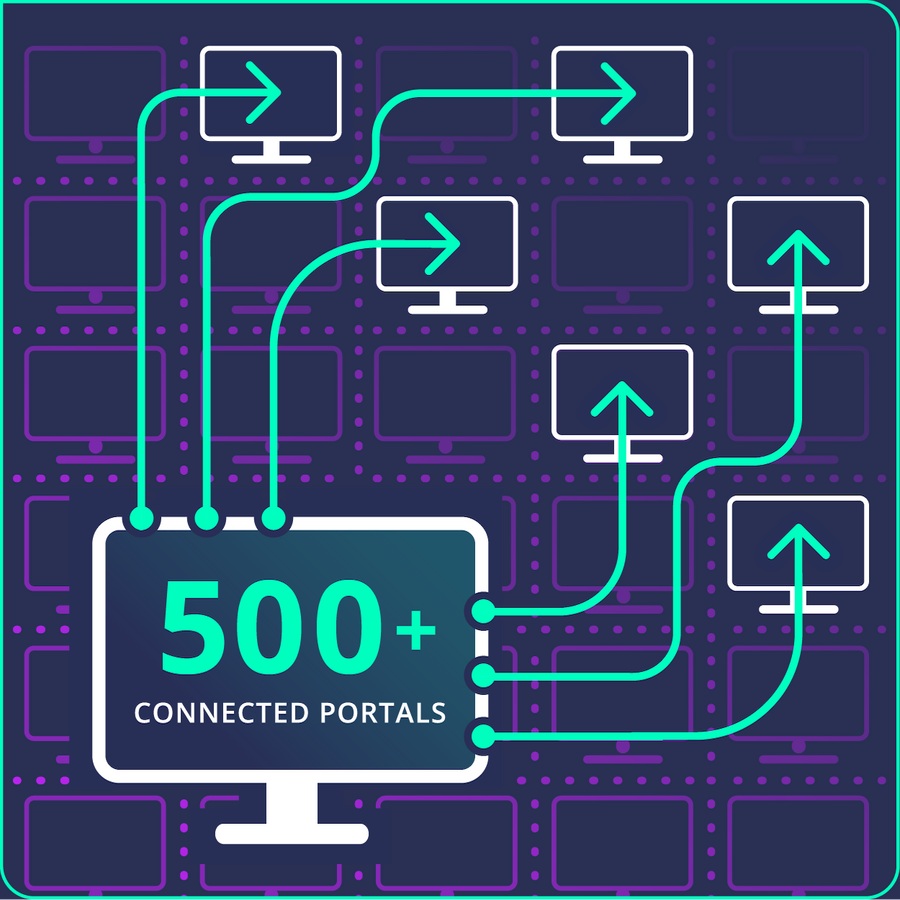

With 500+ connected portals, we’ve slashed document retrieval time by 94%. Spend less time chasing data and more time acting on it.

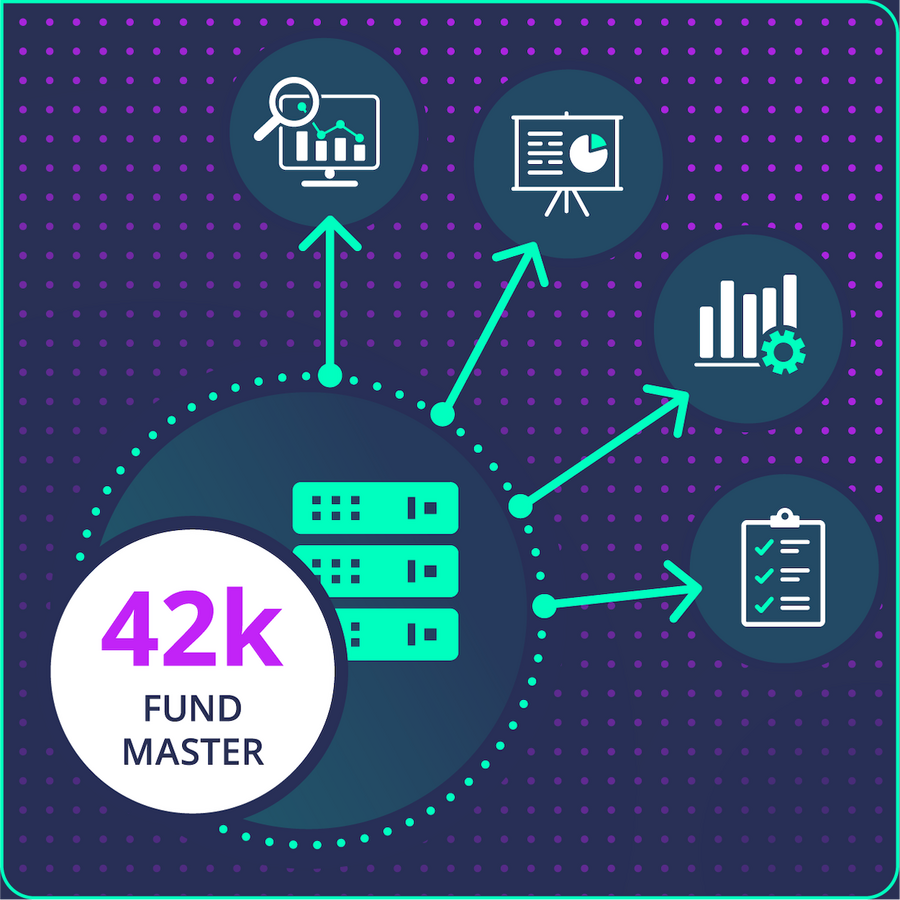

With our robust database of 45K+ funds, you can extract deeper, more comprehensive intel quicker. Illuminate the data buried in your current holdings to eliminate overlooked opportunities.

Get your data your way, within minutes, any time of day or night. Canoe’s system-agnostic approach means we can adapt to your existing systems, not the other way around.

Perks of Joining the Largest Data Community in Alts

Neighborhood Watch

Our network creates a protective ecosystem that looks out for you. When one client receives a document others should have, our system anonymously alerts affected users—often identifying missing documents before you realize there’s an issue. This collaborative approach ensures you’re never operating alone.

Well-Worn Pathways to Downstream Systems

Skip custom integration headaches—we’ve likely built your connection already. Explore our over 500+ partners and integrations here.

Shared Intelligence That Compounds Daily

Most people are realizing, traditional AI is only as good as its training data. With documents processed across 750k commitments, Canoe’s models benefit from unrivaled depth. This training set volume creates a compounding advantage that continuously improves extraction accuracy, processing speed, and pattern recognition—delivering intelligence that grows smarter with every document.

Smarter alts data management starts with Canoe.

See Canoe in Action and start streamlining your alternative investment processes.

Frequently Asked Questions

Canoe implements industry-leading security protocols at every level. We follow the NIST Cybersecurity Framework, maintain SOC 2 Type II certification, and participate in the Blackstone Portfolio Cyber Security Program. Our security infrastructure includes end-to-end encryption, private hosting of all AI models, and comprehensive access controls designed specifically for the sensitive nature of investment data.

While some providers claim “out-of-the-box” implementation, our clients understand that value-additive solutions requires a more bespoke approach. Canoe’s white-glove onboarding includes dedicated specialists who configure our platform to your specific needs, ensuring seamless integration with existing workflows. This curated approach delivers faster time-to-value and significantly higher long-term success rates.

Canoe’s automation immediately extends your team’s capabilities by eliminating manual document collection and data entry. Most clients achieve significant efficiency gains with their existing staff using our platform alone. For those seeking additional support—whether for specific tasks during busy periods or comprehensive outsourcing—our certified partners can seamlessly complement your operations. This tiered approach ensures you maintain complete control while scaling your alternatives program in whatever way best suits your organization’s needs.

Canoe processes the full spectrum of alternative investment documents, including capital calls, distributions, financial statements, K-1s, portfolio company information, performance estimates, and subscription agreements. Our platform handles documents across private equity, hedge funds, real estate, private debt, and other alternative asset classes, delivering comprehensive coverage regardless of investment mix.